नई दिल्ली:

गुरुवार को घरेलू शेयर बाजारों ने तेजी के साथ सत्र का आगाज किया. बाजार वैश्विक स्तर पर कमजोर संकेतों की विपरीत दिशा में बढ़ते हुए नजर आया. आज मई सीरीज के डेरिवेटिव सौदों के निपटान का अंतिम दिन है. तमाम कारोबारी अपनी स्थिति को बेहतर बनाने के कोशिश करेंगे.

बाजार की नजरें आज नरेंद्र मोदी के शपथ ग्रहण समारोह पर होंगी. इसमें बाजार का ध्यान इस बात पर होगा कि देश का अगला वित्त मंत्री कौन होगा. रुपये में 10 पैसे की मामूली बढ़त देखने को मिली. डॉलर के मुकाबले रुपया 69.73 के स्तर पर पहुंच गया.

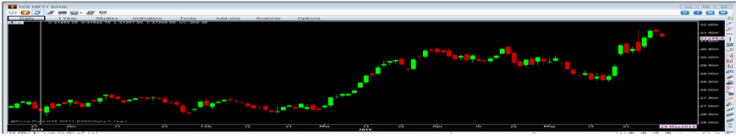

सुबह 9.30 बजे, बीएसई सेंसेक्स 58 अंक या 0.15 फीसदी की बढ़त के साथ 39,560 के स्तर पर कारोबार करते हुए नजर आया. वहीं, निफ्टी 50 इंडेक्स भी 10 अंक या 0.09 फीसदी की तेजी के साथ 11,871 पर रिकॉर्ड किया गया.

बुधवार को अमेरिकी शेयर बाजार में बिकवाली का दबाव देखने को मिला. डाव जोन्स 0.87 फीसदी तक टूटा, जबकि एसएंडपी 500 इंडेक्स ने 0.69 फीसदी तक की गिरावट दर्ज की. नेस्डेक कंपोजिट 0.79 फीसदी का गोता लगाकर बंद हुआ.

बीएसई सेंसेक्स पर Bharti Airtel के शेयर 1.86 फीसदी की बढ़त के साथ 345 रुपये तक पहुंचे. NTPC के शेयर 1.64 फीसदी की तेजी के साथ 133 रुपये के हो गए. Coal India, Bajaj Auto Tata और Consultancy Services के शेयर क्रमश: 1.47 फीसदी, 1.13 फीसदी और 1.05 फीसदी तक चढ़े. यस बैंक में करीब 2 फीसदी की बढ़त दर्ज की गई.

Recent Comments